Magna: Digital ad sales will dip 2% in H1 and rebound in H2

Dive Brief:

- Media owners’ advertising revenues from linear ad sales will decline 12% in 2020, 20% in the first half of the year and 2.5% in the second half, according to a new Magna report shared with Marketing Dive. The IPG Mediabrands unit updated its estimates in response to the coronavirus outbreak.

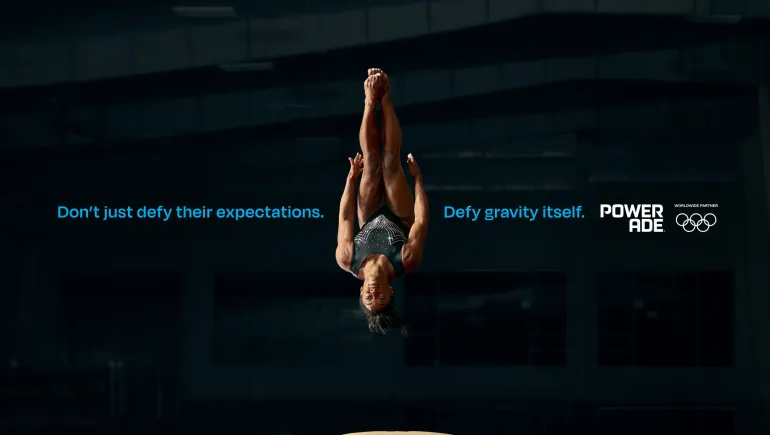

- Digital ad sales for media owners will rise 4% for the year, -2% in the first half of 2020 and up 10% in the second half. Out-of-home (OOH) is forecast to drop 12%, as people are stuck in their homes and less likely to be outside and exposed to such ads during shutdowns. TV ad sales are now expected to drop 13% in response to major live sports organizations canceling seasons and the Summer Olympics being postponed.

- Across all media, ad sales are predicted to drop 2.8% in 2020, per the report. The forecast suggests that total ad market revenues will drop 3%, down $6.2 billion from 2019.

Dive Insight:

The drop in ad sales and revenues now forecast by Manga is less dramatic than losses in 2008-2009, when ad revenues declined 20%, or $33 billion. This is partially due to the strength and resilience of the digital advertising ecosystem despite economic downturns, per Magna. In 2020, search is expected to slow its growth to 4.5%. Next year, digital ad spend is forecast to grow 7%, with social media and digital video showing particular strength.

Other factors potentially mitigating the impact of the pandemic on ad spend this year include an expected 26% lift in political ad spend compared with 2016 during the lead-up to the general election and the fact that sales are set to rebound quickly in the second half, per Magna. The 2021 ad spending forecast is now higher than previous predictions as consumers are expected to make purchases that were delayed during the peak of the health crisis and the fact that the Olympics are now scheduled to take place next year.

“[The current situation’s] effects on supply, demand, and media consumption are more complex and widespread than in any ‘normal’ economic recession in the past, and some of them will outlast the current crisis,” Vincent Letang, EVP of global market research at Magna and author of the report, said in a statement. “Nevertheless, there will be an ‘after.’ At this stage, Magna anticipates ad market stabilization and rebound in the second half of 2020, and moderate growth in 2021.”

Media channels that could be particularly hard hit this year include TV, which is expected to see a 13% decline in ad sales, driven by the loss of televised sporting events as leagues cancel seasons and the Summer Olympics’ postponement, per Magna.

By industry, the impact of the pandemic on marketing activity will vary, depending on how much demand and investment is delayed versus disappearing completely. Some of the hardest areas are likely to be the travel, restaurant and theatrical movie industries. The impact will be significant but not as severe for retail, finance and automotive while a more moderate impact could be experienced by the packaged food, drinks, personal care, insurance and pharma industry. The e-commerce and home entertainment space could potentially see a positive impact on business and marketing activity as more people stay home.

While the revised outlook isn’t as dire as what the ad industry experienced during the Great Recession, Magna admits that it’s still early to tell how the coronavirus and its economic impact will run its course.