Meta ad revenues up 12%, far ahead of Microsoft and Alphabet

The big tech companies’ earnings reports this week showed mixed results in digital ad revenues. Meta had double-digit growth in the second quarter of 2023, while Microsoft and Alphabet were both close to flat.

The winner. Meta’s ad revenue increased 12% to $31.5 billion YoY, beating analyst expectations and returning it to double-digit growth for the first time since 2021. This helped the Facebook/Instagram/WhatsApp parent company grow total revenue by 11%, to $32 billion, for the quarter.

More engagement means more money. Meta saw impressive growth in many key engagement metrics:

- Facebook’s daily active user (DAU) count increased by 5% to 2.06 billion.

- Monthly active users rose 3% YoY to 3.03 billion.

- DAU in the “family of apps” category, which includes Instagram and WhatsApp, hit 3.07 billion, a 7% increase YoY.

- Monthly active users in this category also increased by 6% to 3.88 billion.

Fewer employees also means more money. Meta’s strong performance comes after a string of cost-cutting measures, including laying off more than 21,000 staff members. It also cut spending in some divisions and restructured the hierarchy of the company.

Source: MarTech analysis of Meta data

Earnings report. You can find Meta’s full report here.

Microsoft

A distant second-place finish. Microsoft’s advertising and news search revenue rose by 3% or $86 million – including traffic acquisition costs paid to publishers. Without those costs, revenue was up 8%.

The company said the rise was the result of higher search volume and its acquisition of Xandr, the ad-buying platform it acquired from AT&T. Microsoft said revenue was “a bit behind expectations” due to lower ad spend.

LinkedIn raked it in. Microsoft didn’t report its revenue in dollars (we will update when it does), but did confirm that LinkedIn revenue surpassed $15 billion for the first time in Microsoft’s 2023 fiscal year, following a 5% increase. The company attributed the increase in revenue to growth in Talent Solutions, with some continued bookings hit by a weaker hiring environment in key verticals.

Despite the increases, these numbers were still below what had been forecast in part because of a decline in Marketing Solutions, also due to lower ad spend.

Earnings report. You can read Microsoft’s Q2 performance report here.

Alphabet

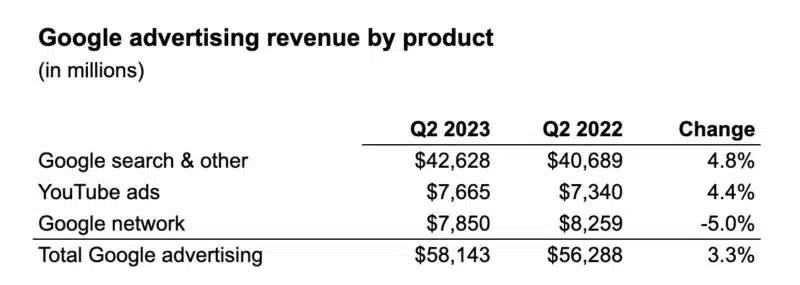

And in third place. Alphabet, Google’s parent company, saw search revenue increase 2% to $1.85 billion. YouTube ad revenue rose 4.4% to $7.67 billion for the quarter. Unfortunately, Google’s advertising network revenue was down 5%.

Although these results surpassed analyst expectations, the single-digit growth indicates digital ad spend hasn’t kept up with the healthy U.S. economy.

“Our financial results reflect continued resilience in Search, with an acceleration of revenue growth in both Search and YouTube,” Alphabet Chief Financial Officer Ruth Porat said in a statement.

Source: MarTech analysis of Alphabet data

Full-steam ahead on AI. Google Chief Business Officer Philipp Schindler said the company will continue to invest heavily in AI.

“Generative AI is supercharging new and existing ad products. We’re helping advertisers to make better decisions, solve problems and enhance creativity. I’m very excited about AI,” he said in a statement.

Earnings report. You can find Alphabet’s report here.

Get MarTech! Daily. Free. In your inbox.